- Policy Analysis

- PolicyWatch 4035

President Trump’s High-Stakes Gulf Trip Requires More Than Good Business

The president is expected to focus on big investment deals and arms sales during his Gulf tour, but he also needs to address some urgent security issues if he wants to come home with a win.

“Business, not policy” appears to be President Trump’s agenda for the first foreign tour of his second term. Yet the Gulf trip comes at a critical time for his administration, with Arab leaders questioning Washington’s regional role, global markets grappling with his tariff announcements, Israel accelerating its offensive in Gaza, and concerns rising over whether U.S. officials can meaningfully set back Iran’s nuclear program or deter its militia partners in Yemen and elsewhere.

The trip is set to begin May 13 in Saudi Arabia, where the president will attend a meeting of the Saudi-U.S. Investment Forum. The next day, he will join a Gulf Cooperation Council (GCC) summit in Riyadh before traveling to Qatar. The final day of the tour will be spent in the United Arab Emirates, though additional stops could conceivably be announced in the coming days.

Overarching Goals

Despite weak oil prices affecting their revenues, the Gulf states are largely unaffected by the president’s recent tariff pronouncements. Thus, even as the White House seemingly stakes the trip’s success on billions—if not trillions—of dollars in potential economic deals, leaders in Saudi Arabia, Qatar, and the UAE appear locked in on securing U.S. diplomatic support, advanced weapons sales, and confirmation of their growing status as global players on the economic and diplomatic stage. Ideally, the president can use his visit to boost those aspirations and ensure they align well with U.S. interests. Failing that, Gulf leaders might deem the trip a (less-rousing) success if Trump simply avoids damaging surprises or unexpected announcements that embarrass them in front of their people.

One can assume that U.S. and Gulf officials have already discussed the extent to which these “asks” will be met. Moreover, Saudi Arabia recently pledged to invest $600 billion in the United States over the next four years, while the UAE committed $1.4 trillion over the next decade. Qatar has yet to mention a figure, but as one of the world’s top producers of natural gas it will undoubtedly go big, in part to keep up with its Gulf peers. Rumors of massive weapons deals have been heard as well, with as much as $100 billion in new arms for the Saudis and a large sale to the Qataris as well. (These deals would include two recently approved sales: $3.5 billion in air-to-air missiles for Riyadh and $2 billion in drones and bombs for Doha.)

Indeed, Trump aims to make the United States the most important partner of the hydrocarbon-rich Gulf Arab states, much like President Biden before him. And as always, this goal will be contested regionally by Iran and internationally by China and Russia, requiring deft U.S. countermoves.

Diplomacy and Regional Security

Aside from his primary focus on investments and arms sales, the president will need to address a few pressing policy issues during the trip. Regarding Israel, a normalization deal with Saudi Arabia is reportedly off the table for this visit, but the administration is attempting to address Riyadh’s concerns by pushing Jerusalem to allow humanitarian relief into Gaza. The Israeli security cabinet recently approved a plan to reoccupy Gaza if no alternative plan emerges from Trump’s Gulf tour, placing the president in a precarious diplomatic position and potentially casting a chill over the GCC summit, where he is likely to receive heavy pushback on U.S. support for Israel.

The final list of who attends the summit may also have implications for how warmly Trump is welcomed to the region. When President Biden joined a GCC summit in 2022, Iraq, Jordan, and Egypt were included as well, so Riyadh might expand the list for Trump too. Yet invitations were apparently sent just days ago, leaving little time for leaders to plan—an approach that could also affect whether Arab heads of state or lower-level officials attend.

The president will also be facing a much different Gulf than he did during his 2017 trip:

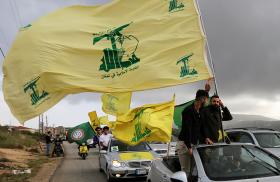

- All of the Gulf Cooperation Council countries except Bahrain have reestablished diplomatic relations with Iran and are unlikely to press for harsh terms during the current U.S. talks with Tehran. Yes, they still hope to curb the regime’s destabilizing regional activities and nuclear ambitions, but their renewed relations with Tehran could lead them to oppose any scenarios involving U.S. or Israeli military action—an important consideration given the substantial role that Gulf bases play in U.S. military deployments and logistics.

- Gulf officials are likely optimistic after President Trump announced the end of the U.S. air campaign in Yemen in exchange for the Houthis halting maritime attacks in the Red Sea region—or some attacks at least. Notably, the president seemed to limit the truce to U.S. targets, and the Houthis underscored that it will not apply to Israeli targets.

- Although Washington remains cautious about the new government in Syria, the Gulf states appear eager to broker a U.S. rapprochement with Damascus, as well as deeper U.S. ties with Lebanon.

- Given the renewed hostilities in Gaza, Gulf leaders will no doubt try to leverage their investment dollars to steer President Trump toward ending the war and pressuring Israel to preserve a two-state horizon with the Palestinians.

Expanding Economic Ties

In line with the trip’s economic focus, the president will likely seek deals in areas such as energy, critical minerals, financial services, and emerging technologies (e.g., artificial intelligence). The Gulf states may see the visit as a chance to accelerate the diversification of their economies away from oil and gas, especially now that oil prices are falling.

For Saudi Arabia, the highlight of the trip will likely be filling in the lines of the reported $600 billion investment and trade deal. Although reporting has been minimal on where exactly those Saudi investments will land, a sizeable portion will probably go toward defense sales, American technology companies, and perhaps even sports franchises. Next week’s Saudi-U.S. Investment Forum meeting will bring Saudi and American business leaders together to explore these and other possibilities.

The president’s visit might also yield a preliminary agreement on a Saudi civil nuclear program. U.S. Energy Secretary Chris Wright addressed this issue during his trip to the kingdom last month, and Riyadh has long sought such a program as part of its Vision 2030 plan to pursue alternative energy. Notably, new reports indicate that the administration has decoupled the Saudi nuclear track from normalization with Israel.

Doha is likewise expected to announce a series of high-profile U.S. investments, including a potential $30 billion Qatar Airways deal to purchase around 100 wide-body jets from Boeing with an option to buy more. Notably, the Trump family company struck a joint deal with a Saudi firm last month to build a $5.5 billion golf resort north of Doha.

As for dealmaking on the last leg of the trip, the UAE’s proposed $1.4 trillion in U.S. investments over the next ten years will focus on AI and semiconductor infrastructure, the energy sector, and manufacturing, according to announcements made by National Security Advisor Tahnoun bin Zayed during his March visit to Washington. These efforts will include expanding partnerships between Emirati companies like G42 and Mubadala and American companies like Microsoft and Intel’s Altera. Relatedly, the Trump administration is mulling whether to ease AI-related restrictions on semiconductor exports to the UAE in order to prevent this key American partner from pursuing Chinese alternatives. In addition, Emirati investment firm MGX is reportedly planning a $2 billion investment in the Trump family’s crypto firm World Liberty Financial.

U.S. Policy Implications

The president’s trip is an important opportunity to strengthen U.S. security and economic partnerships in the region, support the Gulf’s economic diversification efforts, balance U.S. energy diplomacy, and manage local competition with China and Russia. But ambitious investment numbers will not be enough to call the trip a success. Gulf leaders and citizens are deeply concerned about Israel’s threats to reoccupy and clear Gaza, so the president will need to reprioritize a diplomatic push for ending that war. He must also find a way to ensure Gulf buy-in for whatever deal his administration strikes with Iran.

The May 14 GCC summit in Riyadh is a particularly crucial diplomatic moment. During his remarks and conversations there, the president should clearly articulate his vision for the region, including his administration’s strategy for ending the Gaza war, striking a deal with Iran, expanding U.S. strategic ties with Gulf partners, and achieving the deeper regional integration needed for long-term stability and security. On the latter point, he should reemphasize efforts to unite the Gulf countries and avoid a repetition of the diplomatic crisis that erupted as soon as he left Riyadh in 2017. This entails convincing these critical U.S. partners to coalesce around a common vision for Middle East security and prosperity. Trump can easily score a win by reassuring them of America’s strategic commitment to the region, demonstrating consistent messaging, and generally rising above the fray while shaping the broader narrative.

Elizabeth Dent is a senior fellow at The Washington Institute and former director for the Gulf and Arabian Peninsula at the Pentagon. Simon Henderson is the Institute’s Baker Senior Fellow and director of its Bernstein Program on Gulf and Energy Policy.