- Policy Analysis

- PolicyWatch 4166

Throwing Water on Turkey’s Warming Ties with China

Concerns about the Uyghur file, investment risks, and other issues are still constraining the relationship to a certain extent, but fortifying those restraints will require Washington to exert further leverage on several fronts.

The gradual upsurge in both high-level Turkish visits to China and Chinese investments in Turkey points to a potential deepening of their bilateral relations. What is driving these developments, and how likely is it that they signal a major upgrade in ties? Answering these questions in full and assessing their implications for U.S. policy on great power competition and Turkey requires a closer look at the previously cold relationship, as well as the outcome of more recent efforts to warm it up.

The Uyghur Issue and Cold War Frost

For much of the twentieth century, Turkey’s ties with China were frosty, rooted in Ankara’s Cold War politics and support to the Uyghurs. China’s Xinjiang province is historically a majority-Turkic Uyghur area and briefly gained independence under the name East Turkestan in 1933. But the Chinese Communist Party reconquered it immediately after establishing the People’s Republic in 1949. In the following years, many Uyghurs escaped to Cold War Turkey, which allied with the United States against communist China. Although Ankara established diplomatic ties with the People’s Republic in 1971, it continued its policy of welcoming Uyghurs.

Today, Turkey is home to the largest Uyghur diaspora outside of Central Asia, and the country’s nationalist public maintains strong sympathies for this Turkic community. The fact that China was a distant and, for many years, economically weak country meant Ankara could adopt a popular “no cost” policy of supporting the Uyghurs, even though Beijing always considered this matter a grave threat to its national security. More recently, however, China’s rise as a global economic power and the rise of Recep Tayyip Erdogan in Turkey introduced a new dynamism to the relationship.

Enter Erdogan

Since coming to power in 2003, Erdogan has refashioned Turkey’s international identity, adding Eurasian, Middle Eastern, and other global associations to the country’s previously Western tilt. This included an evolution in ties with China, which can be broken down into three phases:

Trade increases, but Uyghur differences remain (2003-10). During Erdogan’s first decade in power, bilateral trade volume increased from $1-2 billion to over $15 billion by 2008, mirroring overall growth trends in Turkey’s economy. Erdogan also visited Beijing in January 2003 just as he was about to take office for the first time. Yet tensions over the Uyghur issue—including Ankara’s public criticism of Beijing, burgeoning Uyghur political activism inside Turkey, and frequent protests in front of Chinese diplomatic missions—blocked any major upgrade in political ties. Following riots in Xinjiang in July 2009, Erdogan accused China of genocide against Uyghurs, further dampening hopes of a swift improvement in ties.

The thaw (2010-18). With China’s economic clout increasing globally, Ankara began to rethink its policy of “no cost” support to the Uyghurs, sending its foreign minister to Beijing in October 2010 to soothe tensions. During the visit, officials made pledges to “jointly crack down on separatism and terrorism, including on anti-China separatist activities in Turkey”—the first time Ankara had labeled certain Uyghur activity as a threat to China. Turkey also began softening its criticism of China’s assimilation campaign targeting the Uyghurs.

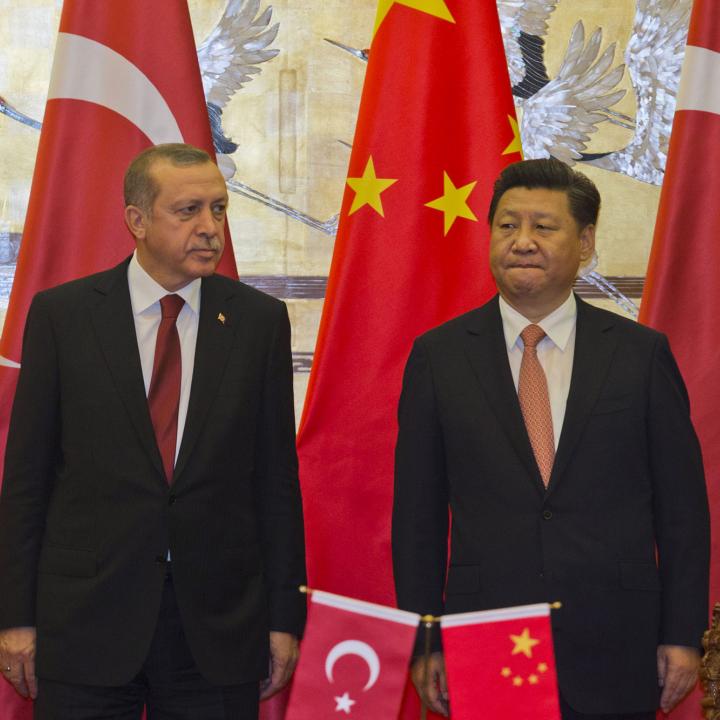

Bilateral visits and cooperation soon boomed, with Beijing hosting Erdogan in 2015, 2016, 2017, and 2019. Turkey also considered purchasing the Chinese FD-2000 missile defense system (deciding against it after pushback from the United States and others). In 2011, Turkey applied to join China’s Shanghai Cooperation Organization as a dialogue partner and was formally accepted in 2013.

Modest Chinese investments in Turkey ensued as well. For instance, Chinese state-owned companies participated in the building of the Ankara-Istanbul High-Speed Railway in 2014. A year later, Chinese companies paid $940 million to acquire a 65 percent share of Kumport. And in 2018, Chinese e-commerce company Alibaba bought a 75 percent stake in Trendyol, one of Turkey’s largest online shopping platforms.

Meanwhile, Turkey designated the East Turkestan Islamic Movement (ETIM), a Uyghur Islamist separatist group, as a terrorist organization in 2017. That same year, Turkey and China signed a mutual extradition treaty on deporting “criminals and terrorists”—a label that many interpreted as Uyghur activists—back to China. Yet while Beijing ratified the treaty in December 2020, Ankara has yet to do so.

Cash crunch spurs bigger Uyghur shift (2018-present). The most dramatic turn in the relationship came in 2018, when Turkey’s economy entered its first recession under Erdogan. The following year, his candidates lost key mayoral elections, signaling that his own electoral success was likely to decline unless he restored economic growth. In response, Ankara began aggressively courting Chinese investment flows while pushing the Uyghur issue to the back burner.

In June 2019, Erdogan’s son-in-law and finance minister, Berat Albayrak, traveled to China and secured a $1 billion currency transfer. When Turkish opposition parties tried to initiate a parliamentary inquiry into the Uyghur issue that same year, Erdogan’s legislative allies blocked it. Ankara simultaneously refused to join calls for a UN Human Rights Council investigation into the condition of Uyghurs in Xinjiang. Since then, Turkey has banned protests supporting the Uyghurs and severely curbed critical news about China’s treatment of them in state-owned media.

In June 2024, Foreign Minister Hakan Fidan visited Xinjiang and noted that the province’s main cities were among the historic sources of Turkish-Islamic civilization. Yet he made no public statements on Beijing’s broader Uyghur policy; rather, he and Chinese Foreign Minister Wang Yi declared that their mutual “support against armed terrorist movements targeting China is complete.”

Why the EU, Not China, Is Turkey’s Dominant Trade Partner

Despite these shifts on the Uyghur issue, massive investments have yet to materialize given China’s lingering doubts about Turkey. For starters, Chinese investors tend to share the concerns that European and American businesses have about Turkey’s weakening rule of law over the past decade. And despite Ankara’s efforts to quiet the local Uyghur community and change its public stance on this issue, Beijing is keenly aware that the well-established, 50,000-strong Uyghur diaspora in Turkey has deep ties to activists still in China. Moreover, Turkey’s parliament has yet to ratify the 2017 extradition treaty, suggesting that Ankara may never completely see eye-to-eye with China on this matter due to deeply held sympathies for Uyghurs among the broader population and policy elites alike.

Tellingly, while Turkey’s multi-aligned foreign policy has substantially boosted its ties with Russia and Gulf monarchies in recent years, China stands out as the only great/wealthy power it has failed to reel in. In 2020, a Chinese consortium paid $689 million to buy a 51 percent share of the largest bridge across the Bosporus, Istanbul’s Yavuz Sultan Selim Bridge, but observers noted this was a smaller share than it normally would have bought. Chinese electric vehicle companies later made larger commitments: in November 2024, BYD announced it would invest $1 billion to build a factory in Turkey’s Manisa province, and in March 2025, Chery announced a $1 billion deal for a factory in Samsun province. Yet these decisions seemed to stem more from business considerations than policy shifts—namely, the existence of a Turkey-EU customs union that allows companies manufacturing in Turkey to sell to EU consumers without paying EU tariffs, and Ankara’s June 2024 threat to impose tariffs against Chinese-made cars.

Indeed, trade relations may have expanded, but they remain tiny considering China’s overall trade volume, and they are hugely imbalanced in Beijing’s favor. In 2023, China exported $45 billion worth of goods to Turkey but imported only $3.3 billion in Turkish goods. The $45 billion figure barely placed Turkey in the top thirty of China’s customers. For comparison, U.S.-Turkish trade that year was estimated at $39.6 billion, not far below the total Chinese-Turkish volume and more evenly balanced between imports and exports. The EU continued to dominate, with Turkey exporting around $118 billion worth of goods to the bloc and importing $134 billion.

Ankara is also disappointed that Chinese foreign direct investment remains unremarkable. In 2024, Turkey attracted $11.3 billion of FDI, but EU countries accounted for 55 percent of this, while China was not even among the top ten (the U.S. share of 10 percent was third after the Netherlands and Germany).

U.S. Policy Implications

The disappointing outcomes of efforts to secure Chinese investment flows have put Turkish relations with Beijing at a crossroads, with Ankara pondering what else it can (or should) do to boost the financial relationship. Meanwhile, Turkish ties with the United States are experiencing a renaissance in light of Erdogan’s major deliveries to the Trump administration (e.g., helping to end the war in Syria) and his formidable chemistry with President Trump. The 2025 U.S. National Security Strategy described China as a “predatory” trade partner and a singular threat to America, while the administration seems to regard Turkey as a middle power that can punch above its weight.

Such views open space for Ankara and Washington to cooperate globally on multiple issues affecting great power competition. If they continue cultivating deeper ties—especially by moving forward with F-35 jet sales—these openings will only widen and proliferate. In the near term, Washington could focus on the following efforts:

- Partnering with Turkish firms to compete in markets across Africa and the Global South. Turkish NGOs, defense firms, and construction companies have built a significant presence in several African countries and the broader Global South. Ankara now sees an opportunity to pair this soft power with U.S. financial institutions to compete against local Chinese influence. In recent years, the United States has seen Gulf firms as the first-choice partners for projects in Africa; Turkey’s political and financial ties with Gulf countries are likewise expanding, which could allow for trilateral pairings (including with the United Arab Emirates, notwithstanding Turkish-Emirati competition on certain fronts). Ankara also has hard-power assets to offer in the Sahel and nearby, including recent defense treaties with Niger and Mali and a military presence in Libya (where Turkish support to the UN-recognized Tripoli government undercuts Chinese support to Khalifa Haftar’s forces in the east).

- Seeking common ground on supporting Uyghur communities in the United States and Turkey. Excluding Central Asian countries, the United States hosts the world’s third-largest Uyghur diaspora after Turkey and Germany. Washington should therefore engage Ankara on potential joint public diplomacy and academic programs to support Uyghur rights globally. If Turkish officials seem hesitant to pursue such initiatives for fear of angering Beijing, U.S. officials could appeal to the strong bond between Presidents Trump and Erdogan (see below).

- Use Trump and Erdogan’s chemistry to ensure Turkey’s “pro-U.S. neutrality” on global China policy. Although Ankara’s self-interest makes it more eager to align with Washington commercially in theaters like Africa, its reflex reaction to potential U.S.-Chinese escalation in East Asia will be to sit it out. As a middle power, Turkey’s goal is to maintain functional relations with both of these great powers. Yet by tapping into the strong rapport between Erdogan and Trump, Washington can likely convince Ankara to at least embrace a pro-U.S. brand of neutrality on East Asia issues, supporting the United States politically when clashes with China emerge even if staying on the sidelines militarily. The Trump administration should also enlist South Korea and Japan to help align Ankara more closely with Washington regarding matters like Chinese posturing on Taiwan, since both of these allies have deep economic, political, and defense ties with Turkey.

Soner Cagaptay is the Beyer Family Senior Fellow at The Washington Institute and director of its Turkish Research Program, where Ela Peterson is a research assistant.