- Policy Analysis

- Fikra Forum

Kazakhstan and the Abraham Accords in the Critical Minerals Hedging Game

Kazakhstan's entry into the Abraham Accords may be designed to facilitate new critical minerals supply chains, reducing signatories' dependence on China.

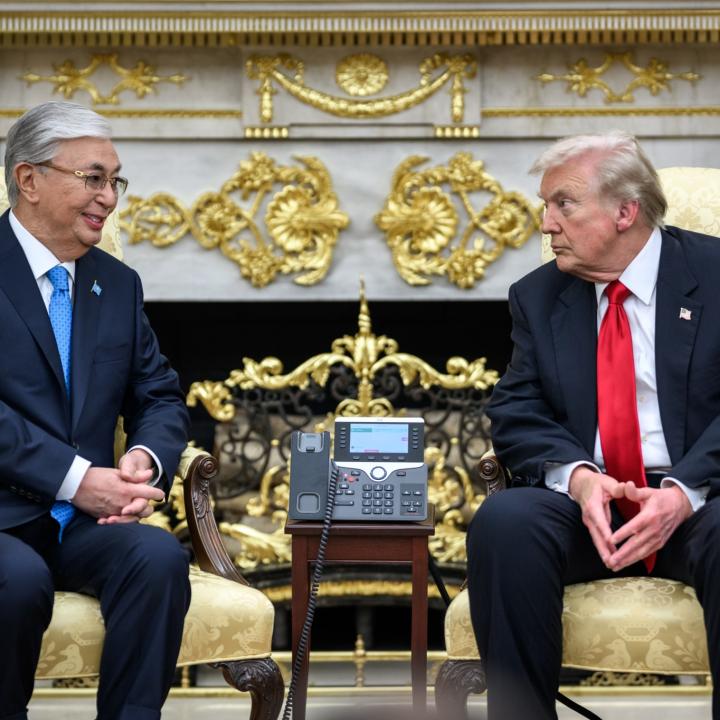

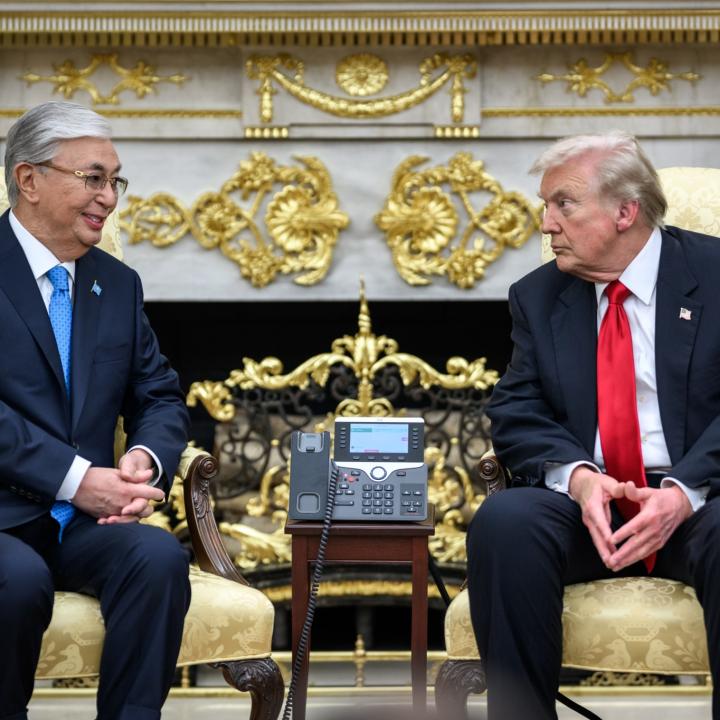

On November 6, 2025, President Trump announced that Kazakhstan would join the Abraham Accords. This makes it the first country with preexisting diplomatic ties with Israel to join. The announcement raised eyebrows among Washington analysts, largely because the two countries already had ties and because Kazakhstan is not in the Middle East or North Africa, like the previous signatories.

On the same day, the C5+1—the Central Asian nations plus the United States—convened in the White House for the first time. There, President Trump noted that “one of the key items on our agenda is critical minerals,” emphasizing a focus on broadening “our critical mineral supply chains.” Notably, according to the U.S. Department of the Interior, Kazakhstan either produces or has reserves of nearly half of the sixty critical minerals vital to U.S. national security. As the U.S.-China competition heats up, critical minerals—and both sides’ access to them—are increasingly at the center of the competition.

The United States and Kazakhstan, like many countries, are currently heavily reliant on China’s role in the critical minerals supply chain. Among the many benefits of Kazakhstan’s addition to the Abraham Accords, the arrangement opens up the possibility for Washington and its partners to diversify their critical minerals supply chain in an effort to become less dependent on China.

Why the Abraham Accords

Kazakhstan’s entrance into the Abraham Accords was unorthodox. Previous signatories joined in order to normalize relations with Israel, often with U.S. encouragement and specific bilateral incentives. Kazakhstan’s addition signifies a notable shift in the U.S. approach, from Middle East and North African countries with little to no diplomatic engagement with Israel, to countries beyond the region that may have prior diplomatic ties.

As the Trump administration's flagship foreign policy achievement, the Abraham Accords can be a powerful tool for facilitating new critical mineral supply chains due to the administration's unwavering support. Washington’s Middle East partners that possess ambitions to build domestic AI and technology infrastructure can be connected to new critical minerals resource-rich partners, with the reduction of China’s role in these new supply chains serving U.S. strategic interests.

Kazakhstan is the world’s leading producer of uranium, providing 40% of the global supply, and ranks third for titanium, seventh for zinc, eighth for lead, and eleventh for gold. With regard to mineral reserves, it ranks second in manganese ore reserves and eighth in global iron reserves. Additionally, it has 30% of the world’s chromite ore deposits and 95% of the chromium reserves that are essential in a variety of industrial applications. Most recently, it discovered a rare metals deposit in the Karaganda region, with some estimates claiming it possesses more than 20 million tons. If confirmed, this could meet the U.S. demand for neodymium magnets, used in consumer electronics and industrial machinery.

Kazakhstan, however, has longstanding economic ties with China, its single largest trading partner, which purchases some 27% of its mineral exports overall and 30% of its natural uranium exports. Kazakhstan is also heavily reliant on the Chinese for domestic investments. Since the inception of the Belt and Road initiative in 2013, the total value of completed Chinese foreign direct investment (FDI) flows to Kazakhstan has reached $5.9 billion, with manufacturing, processing, and natural resource FDI extraction comprising $4.7 billion. These investments have led to projects such as the joint construction of a highly advanced copper smelting facility in the Abai Region, planned to be operational by 2028.

But Kazakhstan is also signaling a growing concern with the risks of economic dependency. Zhandos Shaimardanov, director of the Kazakhstan Institute for Strategic Studies, recently said at the Doha Forum that “to us, autonomy is not about choosing a side, it’s about diversifying our strategic partnerships.” Reflecting this approach, Kazakhstan recently joined the Minerals Security Partnership (MSP) forum, a U.S.-EU-led initiative to promote the development of sustainable critical minerals supply chains through industry and government level investment coordination. At the private sector level, American firm Cove Capital LLC and Kazakh firm Kaz Resources recently announced increased coordination, committing to critical mineral exploration and resource development in Kazakhstan.

Shared Interests

In April 2025, China responded to President Trump’s reciprocal tariffs by placing export restrictions on many critical minerals, recently expanding them to elements used in strategic defense and chip applications. Given China’s monopoly over much of the critical minerals supply chain, such restrictions are potentially debilitating for the United States and many of its allies. As Washington attempts to diversify its entry and exit points along the critical minerals supply chain, the Trump administration is looking to allies for assistance. It is not alone: many other countries are announcing critical minerals strategies to diversify their supply chains and fortify their economies.

Israel is also looking to secure its role in and access to the critical minerals supply chain. Their urgent need for strategic minerals for its defense and high tech industries underscores the value of adding Kazakhstan to the accords, a familiar face with an abundance of critical minerals. Israel’s innovation sector has the capacity to further develop mining and refining technology that excels in energy efficiency, equipment lifecycle, metal recycling processes, and logistics, which presents downstream development opportunities for Kazakhstan.

Middle East countries, in particular Gulf states desiring to lead in green energy, technology, and AI, are likewise dependent on critical minerals. The United Arab Emirates and the Kingdom of Bahrain, original members of the Abraham Accords, have both committed resources to achieve these ambitions.

The UAE is already investing in global mining projects while expanding its own refining capacity. It has consistently signaled that metals are essential to post-hydrocarbon diversification. Additionally, ADQ, Abu Dhabi’s sovereign wealth fund, joined the $1.8 billion Orion Critical Minerals Consortium (Orion CMC) alongside Orion Resource Partners and the U.S. Development Finance Corporation (DFC). This consortium, created to secure investment for near-term mining and refining opportunities, works to address glaring U.S. and allied co-financing gaps at a time when international partnerships are essential to expanding resource security.

In early September, Bahrain announced its sponsorship of Impossible Metals, a Silicon Valley startup that aims to mine critical minerals from the Pacific Ocean seabed. This move is consistent with an April executive order that seeks to establish “the United States as a global leader in responsible seabed mineral exploration,” an area in which China maintains a strong presence.

Recommendations

In order to best capitalize on Kazakhstan’s inclusion in the Abraham Accords, expanding them further while establishing a multilateral working group on critical minerals and augmenting co-investment initiatives can lead both to increased resource sharing between signatories and serve as a lever for Washington and its allies in the strategic competition with China. The United States should:

- Encourage other states that have relations with Israel and key critical mineral reserves to join the Abraham Accords. Washington should facilitate the addition of Uzbekistan, Tajikistan, Kyrgyzstan, and Azerbaijan, which have rich deposits of critical minerals such as indium, rhenium, selenium, and tellurium as well as enormous reserves of antimony, which together are all vital in strategic semiconductors, aerospace, defense, and renewable energy industries. Expansion may make the Abraham Accords more appealing to other countries as well, further growing the network.

- Establish a multilateral critical minerals working group among Abraham Accords countries. The Trump administration should leverage the resource opportunities in Kazakhstan, especially given the hesitancy of Israel’s Abraham Accords partners to convene since October 7, 2023. It should push to establish a durable diplomatic infrastructure with each Abraham Accords country to coordinate, provide oversight, and realize mutual critical minerals ambitions. The endeavor should be low profile and incremental so as not to dissuade participation on political grounds and should emphasize a clear and specific mutually beneficial goal of building a shared critical minerals ecosystem.

- Expand partner co-investment opportunities for critical minerals security. This could take many forms, but the priority should be to expand the Orion CMC—the largest active U.S.-allied initiative to mobilize co-investment for production-ready projects—to other Abraham Accords countries.